The Financial Transaction Tax

The tax targets capitalism systemically through the global financial sector, the most important, strategic site of battle for a systematic approach to reparations as it contains the true value of enslavement and colonialism and targets the power brokers of capitalism and its global governance.

The FTT is tax on global financial market trades for reparative justice and system change as it increases over time to ultimately dismantle capitalism.

Elizabeth II

Inspects gold held at the Bank of England, across rooms the size 3 tennis courts

Jamaican Artist Laura Facey’s 'Their Spirits Gone Before Them’

All wealth under capitalism is stained with the blood of enslavement and colonialismThis FTT is systemic, not reformist

Reformist policies such as wealth taxes or one-off reparations payments miseducate the public and help expand capitalism, which further entrenches racism, inequalities and climate change.

This FTT is systemic, by targeting the epicentre of capitalism, finance capital and therefore the root of power.

Increasing the tax over time systematically strips elites of their wealth and power enabling a just, peaceful and sustainable economy to be born in its place.

Only then are we emancipated and liberated from the legacies of enslavement of colonialism.

It targets the engine of imperialism – the people who control finance capital

It naturally targets the most wealthiest people and corporations on the planet by taxing the trading done on the world’s major markets and ‘assets’ at a wholesale level, such as shares, derivatives, debt, gold and oil markets.

This FTT is a policy proposal that applies to people who are trading on exchanges and markets, (not the trading market infrastructure itself) based in the jurisdiction in which it has been made into law. So if the FTT is made into law in a country, and a financial exchange or market in that country decides to relocate to another country and its wealthy stay behind, they still have to pay the tax

E.g. If the FTT becomes the law in the US, and a US based hedge fund buys oil derivatives in Saudi Arabia where the FTT is not the law, they still pay the FTT. It is known as taxation based on the residency principle of financial instruments similar to the definition used in the UK Labour Party Election Manifesto by former socialist leader Jeremy Corbyn in 2019.

This FTT targets the spoils of enslavement and colonialism

Cruel and contradictory capitalism, which requires injustice and inequality for its growth, can never be free of the blood of our ancestors.

Imperialists have manufactured the debt slavery (valued at $300 trillion) of humanity and future generations, in order for them to enjoy the spoils of our labour. This includes financialisation, the process of legally allowing capitalists to make billions of dollars in profits without even attempting to invest in society, but instead, by trading and speculating in financial instruments across the financial markets, which reinforce their own power in politics.

Our bondage will remain unless we force system change. Only the Ubuntu Restoration Tax targets capitalism at a systemic level for reparative justice and system change through the $16 trillion dollar day financial markets, the value of what they have steal from us every day.

This FTT delivers reparative justice and system change

Reparative justice as truth, healing and repair:

- It raises billions of dollars for immediate reparative justice to pay for the material conditions we need to speak the truth, heal and repair.

- It cancels politically made poverty, hunger, destitution, debt and climate change and other forms of impoverishment

Reparative justice as emancipation and liberation:

- As the tax increases, it will go towards weakening capitalism and imperialism, that is responsible for maintaining the legacies of slavery and colonialism such as racism, inequalities and climate change.

- It enables global socialist and co-operative alternatives that bring freedom and democracy.

For truth, healing a repair

A global policy (the Ubuntu tax) for reparations from enslavement and colonialism

For emancipation and liberation

Raising the tax rate to weaken capitalism in order to change power relations and build a new political economy that is just, democratic, equal and sustainableFinancial markets and imperialism

Merchant banking and insurance sectors were built to trade in and finance 16th century enslavement of people and colonial plunder of resources and lands that decimated cultures, traditions and languages.

Banks and exchanges developed the financial markets as we know them today to firstly exchange and bet on plundered physical goods, and more recently, financial assets on paper from colonial wealth. A clear line can be drawn through history from these atrocities to the financial sector, who continue to act with impunity, in the global north and global south.

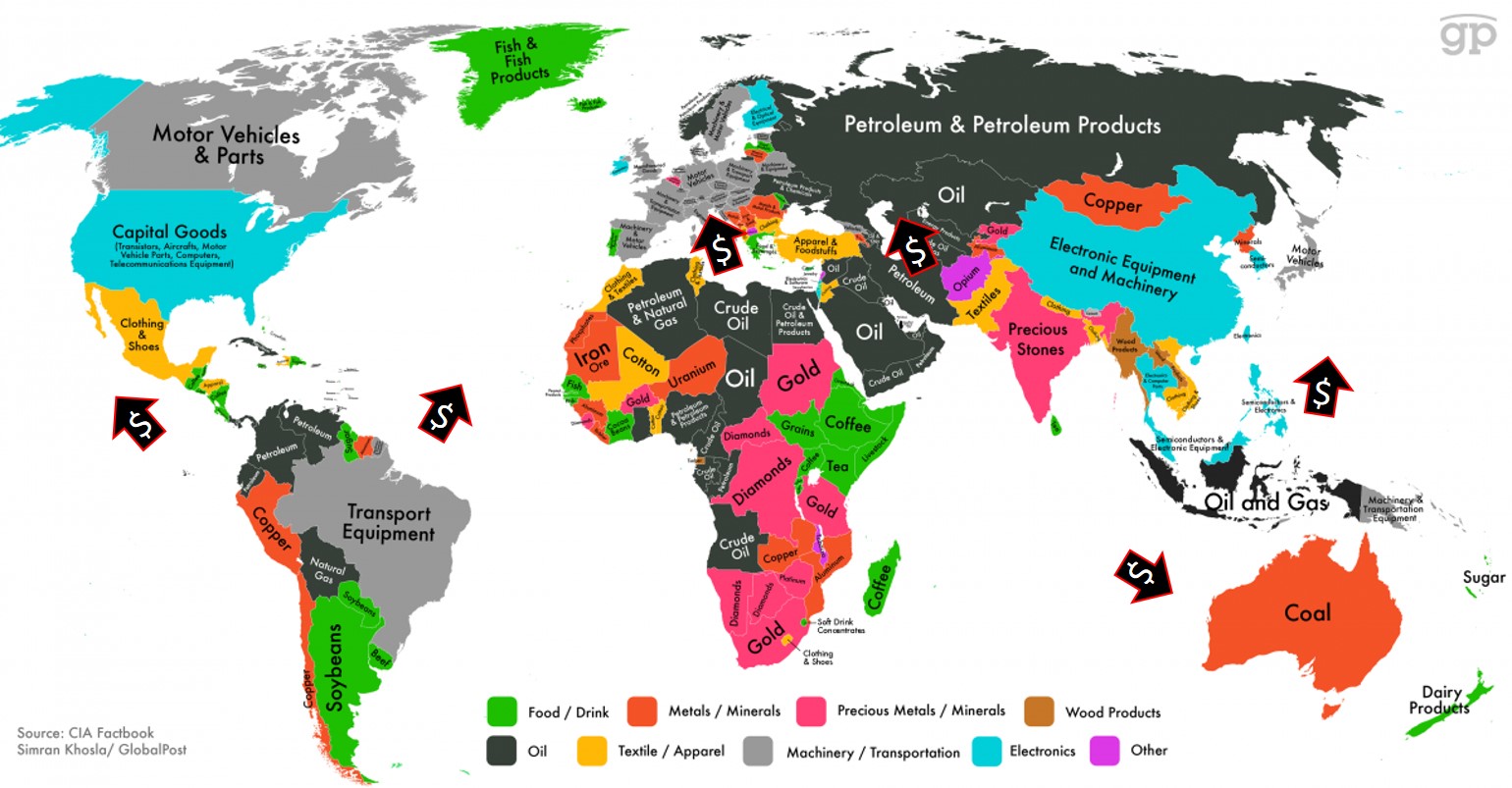

Financial markets encompass trades and bets on shares, or bonds, currencies, gold and silver, and other metals, wheat, sugar, oil and gas, carbon credits, and almost every other conceivable financial and commodity asset, on paper or mined.

Trillions of dollars worth of trades take place between the world’s biggest organisations and the world’s richest people every day. These bets are carried out through organised exchanges like the New York and London Stock Exchanges or off-exchange, or in the over-the-counter (OTC) market bilaterally between investments banks.

The total ‘spoils’ from enslavement and colonialism can be found in the financial markets

The trillions traded in financial markets each day represent the value of the global economy created by imperialists through enslavement and colonialism. The financial markets represents the sum total of debt, asset investments, natural resources yet to plundered, our past and future stolen labour value, future corporate profits, banker’s bonuses and so on. The financial markets are the best indicator of the sum total of the ill gotten ‘spoils’ of enslavement and colonialism. It finance terms, it can be considered the ‘present day value’ of enslavement and colonialism and future imperialism and subjugation.

Financial markets enable trillions of pounds of capital to flow between countries and companies for investment returns; these include companies who supply weapons of mass destruction, fossil fuel companies, mining companies using private militias, companies paying poverty wages, companies whose value chains require human trafficking and modern slavery to survive. The financial markets are a trillions per day global casino, legitimised by a legal system built on colonial ideologies.

The financial markets are opaque, with virtually no public oversight. They cannot even be regulated by their governments, and are offered bailouts despite manipulating markets, currencies, interest rates and crashing economies. Nearly 75% of all trading through financial markets around the world comes out of London and New York – the legacy of colonialism and an indicator of true imperialist power.

Tainted, blood-stained fiat currency (currency whose value is derived in the ‘free-market’) can never adequately honour those enslaved and killed at sea through the Middle Passage, murdered on plantations, or their descendants’ experiences with the violence of structural racism and other systemic injustices from imperialism. In the short-term and as a first step however, reparations from the financial markets are atonements for stolen indigenous people, lands, civilisations, cultures, tongues, economies and faiths to enable us to speak our truth, heal and repair.

In the longer term, the tax will ratchet up so as to interrupt and weaken financial flows, capitalism, and imperialist power, enabling systems change for justice, peace, equality and sustainability.

The tax efficiently targets imperialism

The FTT on financial trading is not just a tax on idle, exponentially growing wealth, it is a tax on exploitative surplus capital, operating capital and power. It is a tax on capital, which is wealth made by people working all over the world and which is accumulating into the hands of the capitalist class. It is they who are determined to maintain a rate of profit, with arms and terror if necessary.

Trading across countries in financial and commodity markets is the most efficient form wholesale capital transfers take place

- The markets enable the capitalist class to move capital between countries, currencies, companies and commodities in seconds.

- They can either buy or sell these assets now, or a sometime in the future, with or without the underlying physical asset using derivative contracts.

- These are tradable legal contracts that allow almost any arrangement of asset, financial or physical to be traded.

- Derivatives provide leverage (or gearing), such that a small movement in the underlying value can cause a large difference in the value of the derivative.

Financial market users can make profits if asset prices move up or down

- Capitalists like volatility and do not care about inflation and can artificially move asset prices virtually at while.

- Their trading is basically riskless because the biggest financial market players are able to arbitrage by simultaneously entering into transactions into two or more markets, cancelling out potential loses. Many derivative instruments avoid capital gains tax.

- Most derivatives are traded bilaterally between the world largest banks and hedge funds with trillions under management in the OTC market. The OTC market is opaque compared to trading done through exchanges.

- The OTC derivative market is the largest market for derivatives. Its regulation is ineffective and inevitably led to collapse of global economy in 2008 as the wealthy in government, in banks and in corporation sought out more and more profits from the poor.

- Although an avid user, Warren Buffet (considered one of the most successful investors in the world and with a net worth of US$78.9 billion as of August 2020, making him the world's seventh-wealthiest person) famously called these “financial weapons of mass destruction”.

The origins of financial transactions taxes

The basic principle of taxing the trading of assets traded between wealthy people is long established

- Taxes on the trade of major assets, such as company stock and property, have been in place for centuries in Western Europe where colonial governments would collect taxes to fund war and imperialism.

- These fixed price taxes were known as Stamp Taxes because in order for the paper that these contracts were written to become lawful, they required a government stamp.

- Colonial Netherlands first introduced them in 1624, followed by colonial Britain in 1694.

By the 1800s, these taxes changed from being at a fixed, to being based on a percentage of the contract’s value. In 1939, the economist John Maynard Keynes advocated for a tax on currency trading because he felt currency speculators would come to dominate the markets as they have done. In 1972, US Nobel prize winning Keynesian economist James Tobin unsuccessfully called for a FTT on wholesale foreign currency trading to ‘throw some sand in the wheels of our excessively efficient international money markets’.

In 2001, Fidel Castro called for a global tax so that “we will have one trillion US dollars annually to save and develop the world. Given the seriousness and urgency of the existing problems, which have become a real hazard for the very survival of our species on the planet, that is what would actually be needed before it is too late.”.

At the Financial Summit in Paris 22 June 2023: Colombia’s president, Gustavo Petro, and Kenya’s president, William Ruto, called for a global financial transaction tax.

40 countries around the world operate miniscule FTTs on predominately the trading of company shares, missing 99% of the financial markets activity taking place across the constantly expanding financial markets landscape. Politically liberal tax and economic justice campaigns have called for more FTTs around the world, including in the UK under a campaign called the ‘Robin Hood Tax’.

This FTT is grounded in the struggles of reparations for enslavement and colonialism, anti-racism, Pan-Afrikanism, the Black Radical Tradition, intersectional feminism, Black Marxism, workers' liberation struggles, Dalit/indigenous struggles and anti-colonialism struggles to create a systemic, radical and non-violent global movement and policy for justice, peace, equality and sustainability.

Our existence on earth is currently controlled through these four markets by the wealthy

The four markets combined are worth $16 trillion per day - this is what they steal from us everyday

Poverty, racism and climate change are the known consequences of political choices

Capitalism cannot effectively sustain life on earth. It can only function through oppression, terror, plunder and crisis.

The cost of living crisis, debt crisis, racist policing crisis, migrant deaths crisis, misogyny crisis, financial crisis, housing crisis, unemployment crisis, wages crisis, food price crisis, climate crisis, inflation crisis, renters crisis, ecological crisis, floods crisis, famine crisis, poverty crisis, mental health crisis, the constant war crisis are not accidents, they are features of capitalism.

Human rights abuses, inequality, poverty, racism, sexism, patriarchy, debt bondage, neo-colonialism, ecocide/climate change etc. are interwoven and inseparable from one another – it is logically impossible to solve for one, without solving for all.

There is no sustainable levelling up under capitalism.

This is why we need to write the rules.

This is why we need system change.

Making the FTT law

$15.8 trillion in global financial markets is the estimated value of what they steal from us each day.

This is the present day value of reparations for enslavement and colonialism and the value of past and future labour of all workers – white and in the global north.

An initial 1% FTT would raise $158 billion per day, equivalent to $40 trillion per year

Financial transaction data that shows the buyer, seller and value of trades is already sent through SWIFT, a financial messaging system that links to up banks, brokers, exchanges, clearing houses, payment systems and governments. The basic technical architecture is already in place.

Legislation would cover the creation and resourcing of Revolutionary Reparations which involves

- Legislating for the FTT

- Appropriating and modifying SWIFT and payments systems to collect the tax through the financial markets and pay into the Revolutionary Reparations Fund that is democratically controlled

- Using these funds to pay for truth, healing and repair from enslavement and colonialism whilst eradiating hunger, poverty, destitution, debt and allowing everyone to thrive and live with dignity.

- Increasing the tax rate so as to weaken Capitalism in order to build a global democratic political economy without Capitalist principles in order for humanity's emancipation and liberation.

G7 countries dominate trading activity where legislation would have to be passed after am unprecedented, sustained, strategic and co-ordinated global campaign.

Learn More

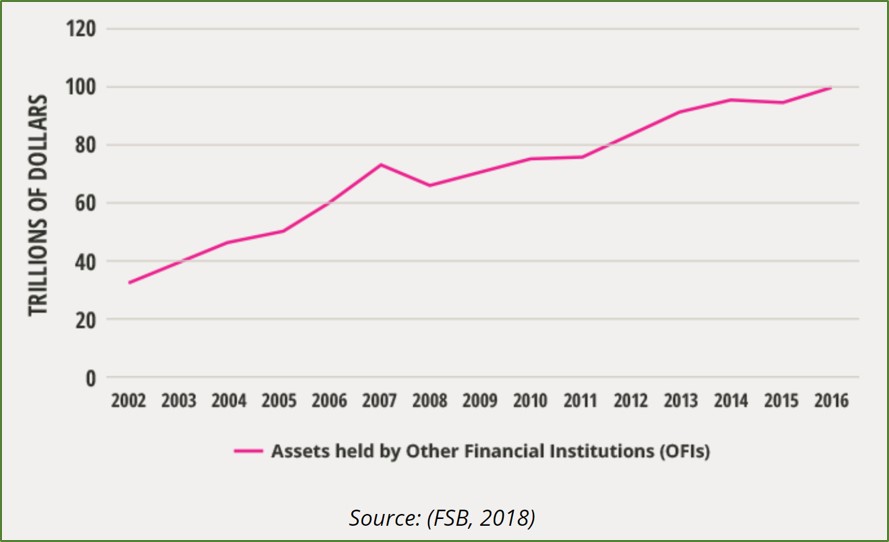

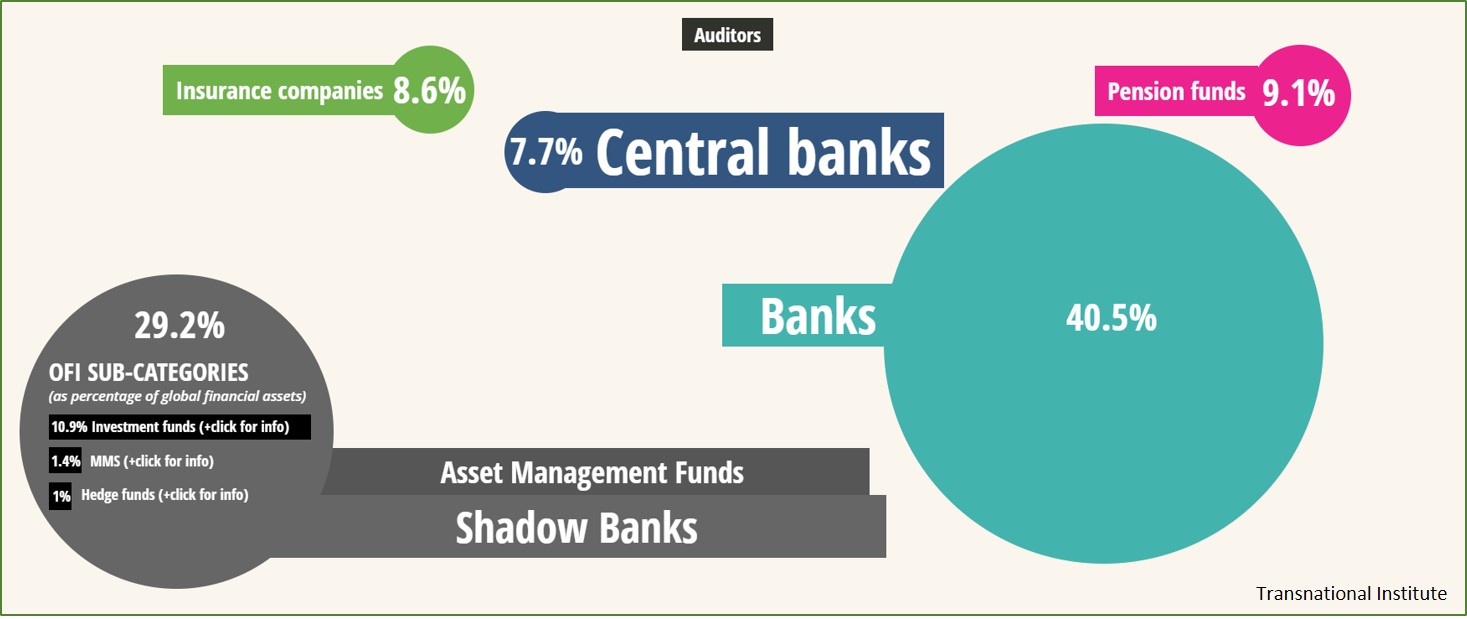

The shadow banking industry is just one example of financialisation, the process of ensuring the strength of capitalist power even as industrial output declines

Wealth and power are held predominately by private banks and the investment industry who dominate political party funding and therefore control government policy

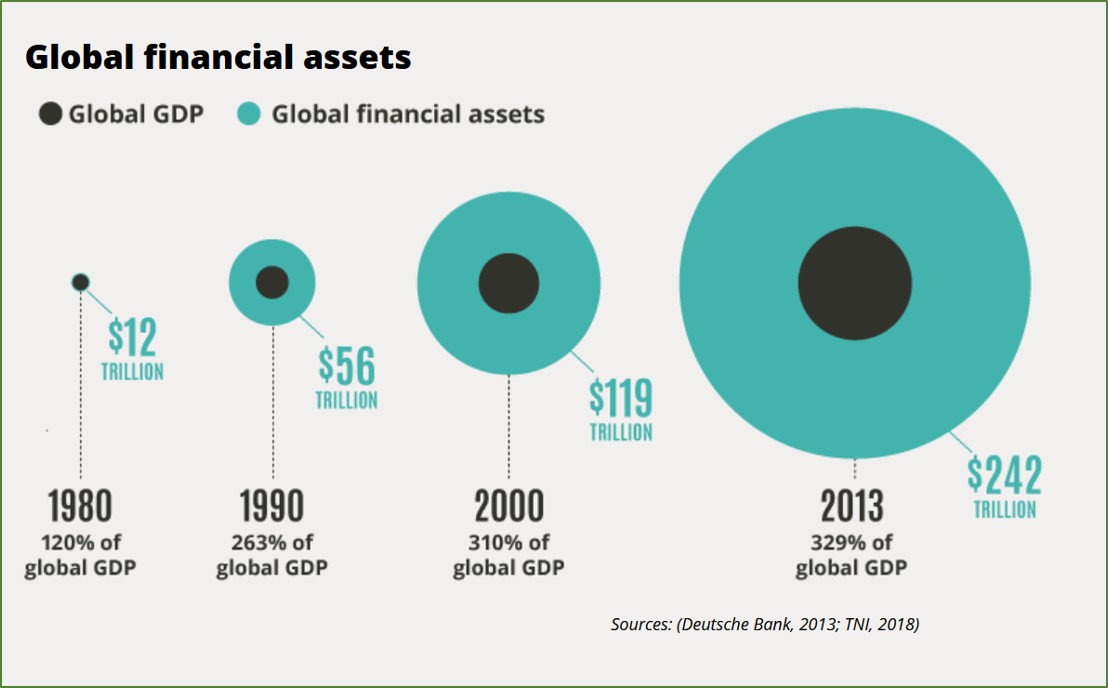

Hyper-financialisation means finance now outstrips GDP by more than 300% - our battleground is the finance sector